The cost of labor for a salaried employee is their yearly salary divided by the number of hours they’ll work in a year. While no one likes taxes, the good news is that federal, state, and local income taxes are withheld — they come out of your employee’s hourly wages or salary, not company revenue. Between 25% and 40% of gross revenue, depending on the type of restaurant. Note that the acceptable labor cost percentages are around 25 and 40 percent for a restaurant. For example, businesses in the service sector might expect the ratio to be 50 percent or more, but the figure may be under 30 percent in the manufacturing sector.

How To Calculate Labor Cost Percentage

It helps you set competitive pricing strategies and evaluate how labor expenses impact profit. Companies that clearly understand total sales percentages can adjust pricing and sales strategies to ensure profitability. The following examples provide a framework for calculating labor costs generally, accounting for gross pay, absenteeism, and employee benefits, among other costs. You can also use Oyster’s employee cost calculator for a more comprehensive estimate of labor costs. When tracking costs and budgeting, some nuts and bolts are easier to count than others.

- Absenteeism can occur for numerous reasons, including personal health issues, family needs, or poor job satisfaction.

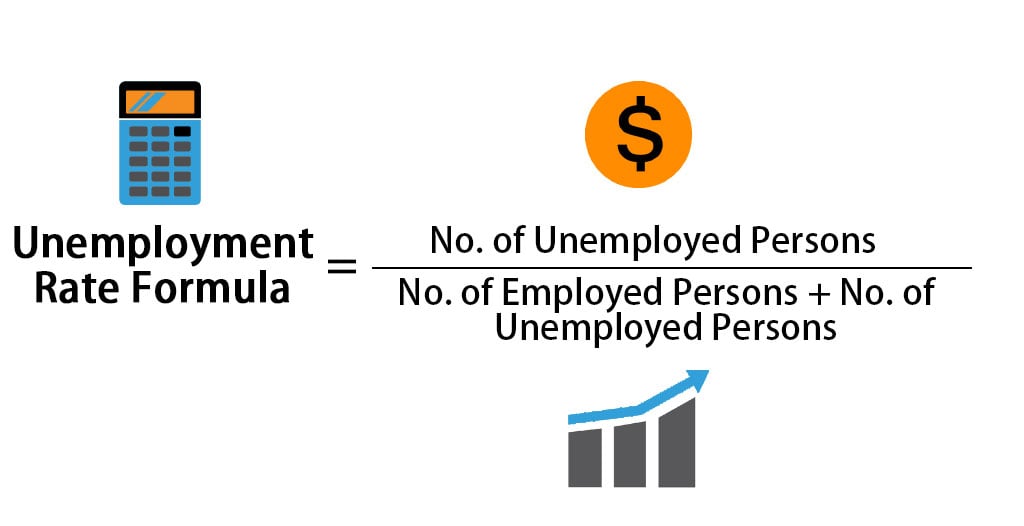

- This key metric displays the overall labor cost as a proportion of gross sales, comparing your total labor costs against your revenue.

- You can even run reports to turn your labor data into easy-to-read charts and graphs.

- Employers should also consider an employee’s overhead percentage when determining the employee’s pay.

- Instead of penalizing the worker, a lower differential price rate is paid for work done below the standard time.

Calculating Labor Costs: A Step-by-Step Guide

When I Work is all about making life easy for small business owners. Every interaction with When I Work is a breeze, including using our labor cost calculator Excel template. Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked. This variance can usually be traced to departmental supervision. This unique component of the Sling software allows you to keep track of your labor budget and receive alerts when you’re about to exceed those numbers. This will help you reduce direct labor cost, save money, and increase profits overall.

Learn what labor rates are and how to calculate them.

On the other hand, sales hires need travel allowances whereas engineering hires most likely don’t. Installing vinyl flooring usually costs between $2 and $7 per square foot. The labor prices vary based on factors like the type annual recurring revenue arr formula calculator of vinyl, dimensions, and installation method. It’s a good idea to contact local flooring installation companies and gather multiple quotes for comparison. Labor costs are one of the biggest challenges facing businesses today.

What Is Labor Cost?

Accurately tracking and managing billable hours can significantly impact this metric. Remember that only productive work should be included when calculating hours sold or billed; non-billable tasks like administrative work or breaks shouldn’t be factored in. When you’re ready to take your scheduling and cost-tracking skills to the next level, you can try the When I Work platform for free. Our 14-day trial gives you a chance to take our app for a test drive. An example is when a highly paid worker performs a low-level task, which influences labor efficiency variance. For this example, we’ve calculated that our employee works 2,000 out of the total 2,080 hours annually.

Keep Track of Labor Costs for Your Business

The average cost of an employee depends on the industry and job role, with adjustments for the local cost of living. The cost of hiring in the United States will differ significantly from hiring costs in Spain. If a three-person auditing team spends a full 40-hour work week auditing a client’s inventory, that equates to 120 hours of labor on that job — three auditors times 40 hours worked each. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. In this system, he is paid a bonus of 50% for the time saved plus the salary for the actual time spent on the job. In this system, workers are given a bonus for completing the task before the deadline.

Entrepreneurs and marketers must ensure that their products or services are priced appropriately based on how much they cost to produce or provide them. By understanding ELRs, they can determine if their pricing strategy needs adjustment or identify areas where operational improvements could be made. An Effective Labor Rate (ELR) is the average amount a business earns per hour for each employee’s work. Implementing incentive programs is an effective way of motivating employees while improving the overall labor rate within your organization.

To begin your labor cost assessment, clearly segment employees based on role and salary. As we stated at the beginning, to get the real labor cost, you need to include all related expenses related to employment. You may also check some other calculators created for different types of costs.